* Terms and Conditions apply.

This is the 2nd of two excellent IB Economics Extended Essays that students have allowed ITS to published on our website.

Janae was an IB student who sat her exams in May 2016. Janae received a 45/45 overall grade for her IB. This is the extended essay she did on the significant and topical issue of the lack of affordable housing in Hong Kong. This problem was viewed in HK as a contributing factor to the ‘Occupy Central‘ movement of late 2014. This in my view is an excellent economics extended essay on the topic of market failure.

I would like to thank Janae personally for allowing ITS to display this EE on our website.

Gary Hadler

Director

ITS Education Asia

[Economics EE - Theory of the Firm]

Research Question: Private home ownership is a merit good with a large amount of positive externalities. The lack of affordable housing in Hong Kong is a major social problem, so what can the Government do to improve Private Housing Affordability for Hong Kong Citizens?

By: Janae Wai

High housing prices are a very significant issue in Hong Kong (HK). The lack of housing affordability in HK is among the most severe in the world. In addition to those who currently cannot afford housing, there are also worries among HK youth that they will not be able to afford their own home in the future. Private home ownership is a merit good that has high amounts of positive externalities. Therefore the government should do more to address the lack of affordable housing for HK residents. This leads to the research question: “What can the Government do to improve Private Housing Affordability for Hong Kong Citizens?”

Secondary research was gathered to demonstrate the types of market failure apparent in the HK housing market and to obtain information concerning the effectiveness of policies that have been used in both HK and elsewhere to deal with the problem. This secondary research was analysed in relation to the primary data collected. The primary research includes interviews with relevant experts and a survey of the HK public to ascertain: a) whether they believe that this is a major social problem b) whether the policies undertaken by the current government are effective, and c) what additional actions can be recommended to reduce the problem.

The investigation showed that market failure was indeed present in the HK housing market. Several solutions were also recommended based on the primary and secondary research. The most supported solutions were those aimed at increasing the supply of affordable housing in HK. Recommendations include that the government should build more low cost housing, establish new towns outside the central business area and reduce government regulations and restrictions that increase the cost of developing new affordable housing. There were fewer consensuses on measures to reduce demand.

i. Private Housing as a Merit Good (Positive Externalities of Consumption)

ii. Government Failure (Positive Externalities of Production)

iii. Negative Externalities of Consumption for Investment Properties

iv. Monopoly Power in the Housing Market

v. Negative Externalities of Construction

The lack of housing affordability has been a significant issue in HK for over past three decades (Wong, D., 1998, p. 53). Following the Asian Financial Crisis, the government, fearing a fall in property prices, “virtually suspended (land sales) from 2000 to 2008”, which restricted the land available for development and limited the housing supply (Yiu, E.C.Y., 2014, p. 25.). One possible effect of this decision could be the high prices experienced in HK today. HK housing in the private sector has been ranked the least affordable in the world, with housing prices over 17 times gross annual household earnings in 2014 (Cox, W. & Pavletich, 2015, p. 13). In addition, compared to other major cities, HK housing is shown to have the highest price to income ratio of 47.37 (Numbeo, 2015.-The Numbeo calculations assume that the net disposable family income is 1.5 x average net salary in a year and an average apartment is 90 square meters). A variety of different factors are responsible for the fall in housing affordability. This can be classified into supply and demand factors

Figure 1: ( Numbeo, 2015)

Private housing is a merit good with large amounts of positive externalities, and the consequences of this fall in housing affordability are becoming increasingly obvious. According to a survey conducted by the Children’s Rights Association, housing is the greatest worry of underprivileged children in HK (Ngo, J, 2015). The lack of affordable private housing may be contributing to negative externalities, such as Occupy Central, as young people feel increasingly pessimistic about their future living standards and are dissatisfied with the direction the government is taking (Bush, R.C., 2014, Lee, B.E., 2014, Pau, J., 2014 & Woodhouse, A, 2015.). This can be seen from the following extract.

The decrease in housing affordability is illustrative of the need for the HK Government to take additional action to correct market failure in the private housing market. It may even be the case that the lack of sufficient action by the government is an example of government failure (Government failure is when government intervention (or lack of intervention) results in less efficient outcomes than what society could potentially achieve.), as the government owns all land in HK, is responsible for leasing it for development and regulates what can be built on it (Community Legal Information Centre & The University of Hong Kong, n.d.). There is a wide range of possible actions that the government could undertake to attempt to reduce the property market bubble. The government could refer to policies adopted in other locations that have been successful in improving housing affordability. Thus this paper will address the question

“What can the Government do to improve Private Housing Affordability for Hong Kong Citizens?

Both primary and secondary research will be conducted. Below is a list of secondary research that will be conducted:

1. Economic theory of market failure

2. HK Government statistics on housing

3. Academic research on housing affordability

4. Critical review of published materials on the problems in the HK housing market

5. Policies implemented by foreign countries to improve housing affordability

Primary research will be done through observations, surveys and interviews. Interviews will be conducted with the financial and administration director of the Urban Renewal Authority, Ms Wai, an economist, Mr Hadler (B. Ec., MBA.), and a professional real estate investor, Mr Cheung. Based on the above primary and secondary research, a stratified survey will be developed and conducted. It will target property owners and non-property owners over 35 or under 25. The purpose of this divide is to see if there are differences in opinions among the older and younger generation. The aim of the survey is to obtain insight on citizens’ views of the lack of affordable housing in HK.

The following section outlines the types of market failure apparent in the HK housing market using information obtained from secondary research and interviews.

Private Housing as a Merit Good (Positive Externalities of Consumption)

Numerous sources of secondary and primary research support the view that affordable housing is a merit good (Merit goods are goods or services that are determined to be desirable to consumers but are underprovided by the market.) with a large amounts of positive externalities (Hadler, G. 2015, Musgrave, R.A., 1959, pp. 13–14, Pettinger , T., 2011 & Paavola, J., 2008.). This is due to the following reasons:

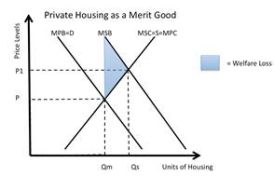

Therefore, the marginal private benefit, which is the additional benefit received by consumers who purchase their own home, is less than the marginal social benefit, which is the additional benefit to society from the consumption of an additional housing unit. This results in welfare loss (Welfare loss is the cost to society created by market inefficiencies), as there is a reduction in social benefits due to the misallocation of resources (Chart 1).

|

Key: MPB= D= Marginal private benefit= demand MSFigure 3:B= Marginal social benefit MSC= S= MPC= Marginal social cost= Marginal private cost= Supply Qm= Quantity produced under free market system Qs= Socially optimal quantity [6] Assumed as under ceteris paribus conditions |

fn6 - The socially optimal quantity reflects the allocation of resources most desired by society as a whole

Government Failure (Positive Externalities of Production)

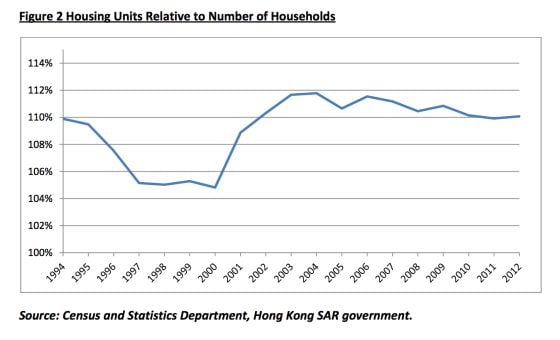

The low levels of supply can be partially attributed to government failure. Although HK is largely a market-based economy (A market based economy is organized so that prices and production are based on supply and demand), the government is involved in the housing market (Lam, P.L., 2014.). An example of this is the restrictive land use regulations placed by the Government (Cox, W. & Pavletich, 2015, p. 12). There is a large amount of spare capacity available for development, as over 60% of HK land is not utilized and is classified as “woodlands, shrub lands, wetlands, and marshlands”, whereas only 6.9% of land is used as residential areas (figure 2). However, the Government favours environmental sustainability and is therefore unwilling to develop this land (Lam, C., 2011, Planning Department, 2014.). The opportunity cost (opportunity cost is the next best alternative forgone) of preserving marshlands has resulted in the under allocation of land resources towards the development of housing, leading to allocative inefficiencies (Allocative inefficiencies occur when resources are not allocated in the combination and quantity most desired by society as a whole).

Another instance of government failure may be its outdated policies that partially contribute to rising home prices. Currently, 6.1% of land is classified as “agriculture land” and is set-aside for native people as a part of the New Territories Small House Policy (For more information about agricultural land, native people and the small house policy, please see appendix I)(Leung, C. & Tang, E., 2014, Planning Department, 2014.). This can be seen as an inefficient use of resources, as these rights have been abused and monetized by villagers (Chan, O., 2014, Designing Hong Kong, 2014, Wai, F, 2015 & Cheung, P., 2015.). In addition, although the four largest developers in HK have purchased over 101.2 million square feet of agricultural land, they are reluctant to convert the undeveloped plots into residential areas, because to alter the purpose of land, they must pay a land premium (A land premium is a fee paid to the government in order to alter the purpose of the land) to the government (Leung, C. & Tang, E., 2014. & Brownlee, I, 2015.).

The effects of these policies can be analyzed using a diagram showing positive externalities of production for housing (Chart 2). Because of the low supply and restrictions on land use, the marginal private cost, which is the cost of producing one additional unit of housing to producers, is greater than the marginal social cost, which is the cost of producing one additional unit of housing to society. This results in welfare loss, as a lower quantity of housing is produced at a higher price.

|

Key: D= MSB= MPB= marginal private benefit= marginal social benefit= demand MSC= marginal social cost MPC= S= marginal private cost= supply Qg= Quantity produced under government intervention Qs= Socially optimal quantity Assumed as under ceteris paribus conditions |

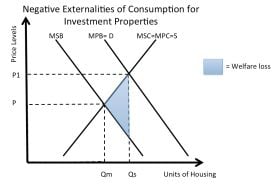

Negative Externalities of Consumption for Investment Properties

Private housing is underprovided and unaffordable partially due to over speculation (Speculation is when investors have a high demand for a good based on its expected future price) of investors in the property market. In the interview, Ms Wai attributed the high prices to the high levels of demand from HK and Mainland Chinese investors (Wai, F. 2015). This leads to constraints in supply for those who wish to buy a home to live in. Over speculation has lead to negative externalities of consumption for private housing. Although there are currently enough units for each household (figure 3), the distribution of housing units is heavily unequal, and in 2011 only 36.50% of households own private housing (Yan, L., 2013.). This suggests that a significant portion of housing is being held by a relatively small amount of households for investment purposes.

|

Key: MPB =D = marginal private benefit= Demand MSB= marginal social benefit MSC=MPC= S= Marginal social cost =Marginal private cost= Supply Qm= Quantity produced under free market system Qs= Socially optimal quantity |

As seen in the Chart 3, the marginal private benefit, which is the additional benefit to consumers from investing in one more unit of housing, is greater than the marginal social benefit, which is the additional benefit society receives from the consumption of one more housing unit for investment. This leads to welfare loss for the following reasons:

Thus, the overconsumption of property for investment purposes contributes to lower living standards and health problems for society.

Monopoly Power in the Housing Market

The real estate market in HK to some extent can be seen as an oligopoly (An oligopoly has several large firms with a dominating market share) (Cheung, P., 2015 & Hong Kong Real Estate Investor, 2014.). Firstly, the government owns all land and leases it at auctions to property developers at a high price (Community Information Legal Centre & The University of HK, n.d.). This is a significant source of Government revenue (Research Office & Legislative Council Secretariat, 2013, p. 12.). In addition, in the interview with Mr. Cheung, he claims that property developers are price makers and can restrict land and housing supply (Cheung, P., 2015). High real housing prices have been shown to have a positive correlation with stock prices of developers (Leung, C. & Tang, E., 2014.), and because the aim of developers is to maximize shareholder wealth, they have no incentive to greatly increase supply and hence allocate more weight to larger, luxurious housing units, instead of smaller flats, which are in higher demand (For more information about the allocation and demand for housing units, please see appendix III). There is therefore conflict between the private costs and the externalities associated with developing new housing, resulting in allocative inefficiency (Allocative inefficiency occurs when the economy fails to allocate resources in a combination and quantity most preferred by consumers). Although real estate developers receive a greater private benefit from maximizing profit through selling more large flats at a small supply, society would benefit more from an increase in supply of affordable private housing, leading to welfare loss.

Negative Externalities of Construction

When considering the level of market failure associated with housing, it should also be noted that the construction of housing also produces negative externalities. This may result in welfare loss, as illustrated by the table below:

| Table 1: Welfare loss caused by the construction of new housing |

|---|

|

The welfare loss caused may increase the difficulty of calculating the socially optimal level of housing.

In the interviews with Ms. Wai and Mr. Cheung, both parties have cited the high demand of housing and the insufficient supply as the primary cause behind the unaffordability of private housing (Cheung, P., 2015 & Wai, F., 2015). The shortage of housing leads to high prices and a loss in consumer surplus (Consumer surplus is the difference between the highest price consumers are willing to pay for the good and the actual price they pay for the good). Ms. Wai also identified other factors of production, particularly material and labour cost, to be a contributor to high housing prices (Wai, F. 2015). Due to “the reluctance of young people to join the (construction) industry”, there is a shortage of construction workers in HK, and their wages have been pushed up as a result (Sito, P., 2014, Siu, P., 2014.). As a result, the cost of producing housing has further increased and is passed on to consumers due to the highly price inelastic (Consumer demand for the good is unresponsive to a change in price) demand for housing, making housing less affordable.

| Table 2: HK Government Policies that are currently used to improve Private Housing Affordability [20] | |

|---|---|

| Supply Side Solutions |

|

| Demand Side Solutions |

|

| (FN 20 For more information about the individual policies used, please see appendix IV) (FN 21 As the value of the property purchased increase, the percentage paid in tax increases) |

|

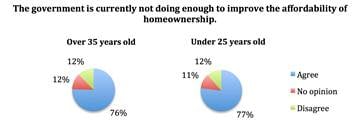

Although the government may have decreased the rate of growth in prices, housing prices has continued to rise (Global Property Guide, 2014). This suggests that the measures the government is currently taking are not enough to improve housing affordability. Therefore, the government should look into undertaking additional policies and evaluate whether they would be applicable to HK.

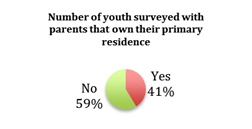

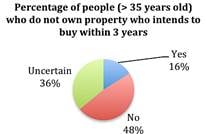

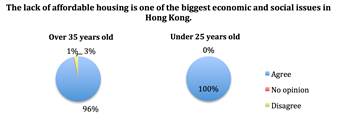

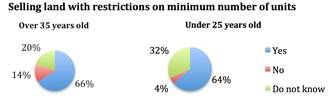

To assess the public view of the housing market and consider what policies should be used in the future, a survey of HK residents was conducted. The survey was given to residents 25 and under, as well as residents 35 and over. A total of 145 citizens were surveyed. It investigates what people think the government is currently doing about the housing problem, how successful they believe these policies are, and which other policies they believe would be effective at reducing housing unaffordability in HK. The survey also attempted to find out whether the HK population believes that the lack of affordable housing is a significant problem. The separation of age groups in the survey was chosen to see if there is divergence of opinions between the older and younger generation concerning this issue.

|

Section A : Information concerning whether or not the people surveyed owns property |

|

|

Chart 4.1  |

Chart 4.2  |

|

Chart 5  |

Chart 6  |

|

Key Points about Data |

|

|

Section B : |

|

Chart 7 :  |

|

Chart 8 : |

|

Section C : |

|

Chart 10 :  |

|

Chart 11 :  |

|

Chart 12 :  |

|

Chart 13 :  |

|

Key Points about data : |

|

Section D : |

|

Chart 14 : |

|

Chart 15 : |

|

Chart 17 : |

|

Chart 18 : |

|

Chart 19 : |

|

Key Points about Data : |

The following section covers what policies those interviewed believe are effective.

|

Table 2: Expert Opinion regarding the which policies would be effective in increasing housing affordability |

|||

| Policy | Urban Renewal Authority Director (Ms Wai) | Real Estate Investor (Mr Cheung) | Economist (Mr Hadler) |

|---|---|---|---|

|

Increase land sales |

Effective | Effective | Effective |

|

Build more subsidized housing |

Effective | Effective | Effective |

|

Streamline process to reconstruct housing |

Effective | Effective | Effective |

|

Stamp Duty |

Ineffective(too low) | Ineffective(too high) | Effective |

|

Capital Gains Tax |

Ineffective | Effective | Effective |

|

Give Government guaranteed loans to first time homebuyers |

Ineffective | Ineffective | Ineffective |

|

Develop more New Towns |

Effective | Effective | Effective |

|

Import more foreign workers for construction sector jobs |

Effective | Effective | Effective |

A large proportion of people who are primary property owners also have investment property. The people who do not own property are pessimistic of their ability to enter the property market in the near future. This suggests that the property market is difficult to enter, which supports the secondary research found that the distribution of housing is uneven.

Both survey and interviews supported the government trying to reduce the problem by increasing the supply of lower cost housing. This was evidenced by the broad support by all for increasing land sales, building more subsidized housing for low income earners and developing new towns as a way of increasing the supply of low cost housing. Other measures suggested to increase the supply of housing also gained some support from the primary research, such as exempting first time homeowners from stamp duty.

The policies aimed at reducing demand gained greater levels of support from the survey respondents as compared to the expert interviews. There was strong support for a capital gains tax on investment properties from those surveyed, however Ms. Wai believed that it would be ineffective. Those interviewed were supportive of the government policy to import construction workers but this policy had limited support from those surveyed. The survey was strongly supportive of Government guaranteed loans for first homebuyers but those interviewed seemed to think that the problem was due to a shortage in supply, so the measure may simply increase prices and not address the problem. There also appeared to be disagreement among those surveyed and interviewed about whether or not the stamp duty effectively deals with this issue.

In order to analyse the policies suggested, the data has been complied into a table and each policy represented is given a number.

|

Table 3: Secondary Research Recommendations |

|

| Supply Side Solutions |

|

|---|---|

| Demand Side Solutions |

|

The majority of policy recommendations were extensions of current policies that are already being used to increase housing affordability in Hong Kong (P.16). This includes increasing taxation on foreign property buyers, increasing lower cost land sales to developers, increasing conversion of agricultural land to residential areas, and relaxing the plot ratio of buildings. Overall, there was greater consensus for policies that were aimed at increasing supply, whereas there was more divided opinions regarding the effectiveness of policies influencing demand. There were no major criticisms of the policies currently in use by the government, other than that the government should implement these policies on a greater scale. However, the effectiveness of the stamp duty policy remains somewhat controversial among the research published.

Policies that were recommended by both Government sources and professionals from the housing industry include (4), (5) and (10). Policies that were recommended by professionals but were opposed by the government include (1) and (10). The difference in opinions regarding (1) appears to be due to the political unpopularity of removing the small house policy among indigenous villagers. The government may be unwilling to carry out policy (3) and (11) on a greater scale due to budgetary reasons.

The research supported the government carrying out policies recommendation (6), (7) and (8), as they have been successful in increasing housing affordability in similar cities and may be applicable to HK.

Based on the primary and secondary research conducted in investigating the question “What can the Government do to improve Private Housing Affordability for Hong Kong Citizens?”, the following conclusions and recommendations have been arrived at.

The premise of the question was well proven. Private housing affordability in HK is one of the worst of any major city globally. As shown by the research, private housing in HK is significantly more unaffordable than any of the other major cities illustrated. This suggests that the free market quantity of private housing is lower than the socially optimum level, resulting in welfare loss. Both the primary and secondary research strongly supported that private home affordability in HK is a significant issue.

The research also strongly supported the view that the lack of housing affordability was an example of market failure. Both the primary and secondary evidence showed a variety of different market failures relating to this issue. The interview findings and secondary research supported the view that the ownership of private housing is a merit good that can be associated with financial security and personal happiness. Private housing affordability is also shown to have positive externalities such as economic growth and a more harmonious society. The research also supported that the under provision of private housing has to some extent led to negative externalities such as a more unequal income distribution and social discontent (especially among the young). This illustrates the need for the Government to increase private housing consumption to bring about welfare gain in HK.

Restrictive land regulations by the government may be a source of government failure, as it results in less housing being built. In relation to the specific issue of Occupy Central, while the older generation and the secondary research was sympathetic of the view that unaffordable housing contributed to public discontent with the government, a great proportion of the younger generation surveyed did not feel this was as a significant factor. This was interesting as the protests were largely driven by the younger generation.

In relation to the question about what the government can do to reduce the problem there was broad agreement in some areas and disagreement in others. The policies that had broad agreement were outlined in the data analysis of the primary and secondary research. Both generations surveyed generally agree about what should be done. The policies with the broadest public support were mainly aimed at increasing supply, for example, that the government should provide more low cost housing for those financially disadvantaged and make more land available for construction of low cost housing. These policies are largely supported by the experts interviewed and the secondary research.

However, the policy options aimed at reducing demand overall had less agreement. The public survey was much more supportive of these policy initiatives than some of the experts interviewed. There were some differences in what the experts thought should be done compared to what the people surveyed thought. There was a feeling among those interviewed that measures, such as stamp duty or a capital gains tax, may instead drive up prices rather than increase the supply of affordable housing. There were also some differences between what government sources believe is effective compared to what professionals from the private sector believe is effective. In addition, there were conflicts in opinion among professionals in some areas.

There did not seem to be a single measure that people thought would solve the problem, therefore any solutions are likely to need to be a combination of different policy measures.

Based on the research, the following recommendations are offered.

(1) The government should for the most part continue with the actions that they are currently taking to reduce this problem.

(2) The government should make greater efforts to publicise and explain their policies (i.e. the importation of construction workers, the current rates of stamp duty) as some these policies does not have strong support.

(3) The government should expand the building of low cost housing for economically disadvantaged residents. This could be achieved by developing new towns outside the city area.

(4) The government should consider restricting the amount and type of home ownership allowable for non-permanent HK residents.

The problem of lack of affordable housing and the associated market failure problems that arise will not be easy to solve. Even if all of the above recommendations are adopted, the problem is unlikely to disappear completely. The fundamental issue is that supply is growing more slowly than demand for low cost housing. This is a market-based problem that the government can influence but may not be able to solve completely. There was no way to know, given the scope of this paper, to what extent the problem would be reduced, even if the government were to follow some or all of the above recommendations.

The theory suggests that there is a socially optimal quantity of private housing in HK and if this is not achieved there will be a welfare cost to HK. However it is not actually possible to know what this quantity is, and it is difficult to quantify how much quantity demanded and supplied has to be altered in order to achieve a socially optimal level.

The research has made no attempt to determine the cost of the above recommendations. While building more government subsided housing is a popular policy, it is also expensive to implement on a larger scale. No consideration has been given to possible opportunity cost of the government following some or all of the above recommendations. Building more housing may require higher tax rates, which HK citizens may be reluctant to pay. The negative externalities that arise from the construction of new housing have also not been taken into consideration.

The survey was conducted using an online platform and does not reflect a scientific or systematic approach to finding targeted individuals, therefore it may contain bias and may not be reflective of the HK population in general or the specific age groups surveyed. Social media was to some degree used in order to encourage a larger survey response. In addition, the interview results could have been more comprehensive if more of the experts were willing to give their opinion about this issue. The ideological bias of the interviewees might also be limiting the validity of the conclusions drawn.

The depth of research was further limited by time constraints and the need to meet deadlines for drafts and final version of the essay.